The Fed and Mortgage Rates: How Interest Rates Affect Mortgages

The Fed and Mortgage Rates: How Interest Rates Affect Mortgages

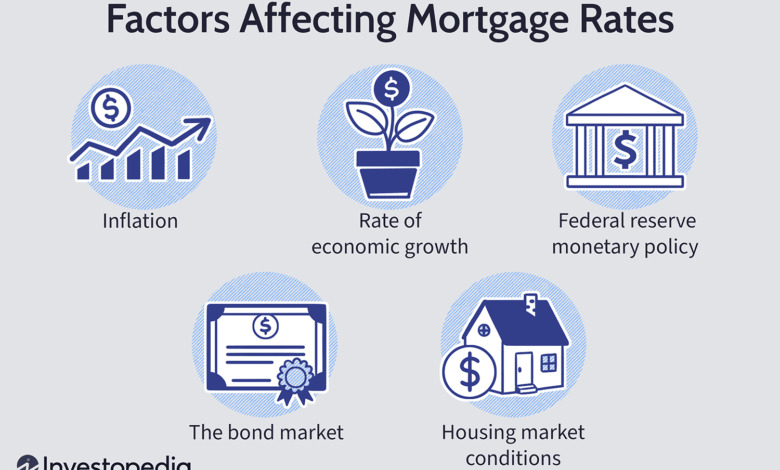

The world of interest rates and home finance certainly looks exceedingly complicated to those without an accounting degree. While most of us are aware that mortgage rates fluctuate, we are not very knowledgeable about the reasons behind it. In actuality, mortgages and interest rates are directly impacted by the Federal Reserve’s operations.

Continue reading to find out why the actions of the Fed might affect your mortgage rate, either higher or lower.

The Federal Reserve: What Is It?

Let’s take a moment to recap what the Federal Reserve is before we get into how the Fed affects mortgages and interest rates. The US central bank is called the Federal Reserve. Although it is independent of the government, its duties include maintaining economic stability and overseeing the nation’s monetary and currency policies.

Because of these obligations, the Federal Reserve has an effect on almost every aspect of your financial life. They affect the interest rates on business loans as well as credit cards. As they are responsible for managing inflation, they may also regulate the amount you spend for necessities.

Interest Rates: What Are They?

We frequently hear about interest rates on a variety of topics. Our savings accounts, auto loans, mortgages, credit cards, and student loans all have interest rates. How do interest rates operate, though, and what are they?

In essence, interest rates are fees that you pay to the bank in exchange for them giving you money. You are paying the bank a tiny portion of the loan amount as interest on a vehicle note or mortgage in exchange for the ability to borrow money from them. The bank pays you interest on savings accounts so that you may use your funds to support other activities.

Rate of Federal Funds

However, the interest on overnight reserve loans is what is meant to be referred to when you hear about the Fed lowering interest rates. To reach required reserve levels, banks lend money to one another overnight. With the Federal Reserve acting as a guidance, lending and borrowing institutions separately negotiate their interest rates.

One Comment