What Is GAP Insurance and Do You Need It?

What Is GAP Insurance and Do You Need It?

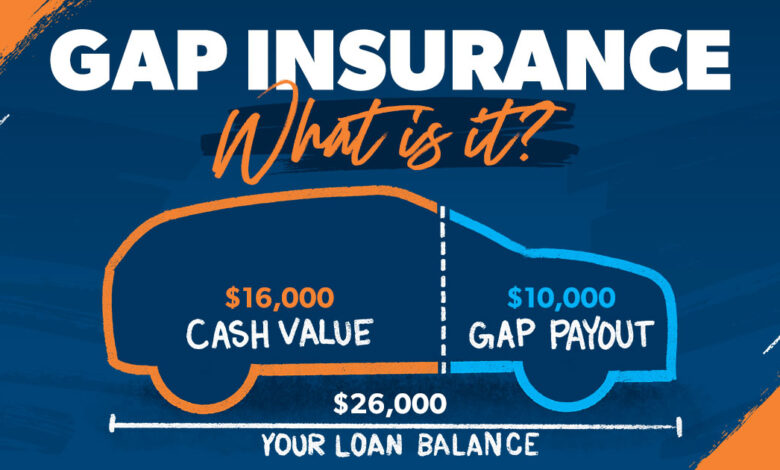

Guaranteed Asset Protection insurance, or GAP insurance, guards your car investments in the event of a total loss from theft or an accident. GAP insurance makes up the difference if you owe more on your auto loan than the car’s true value.

When you purchase a vehicle, motorcycle, van, camper, or new or used automobile, you probably take every precaution to safeguard your investment. The dealership may offer you a service contract, roadside assistance, or even an extended warranty. However, in the event of an accident or theft, your insurance would only cover the car’s current worth, which can be less than what you bought for it or still owe if you have a loan.

Simply put, GAP insurance guards your money in the event that your car is stolen or totaled. The “gap”—the difference between what your ordinary insurance pays out on a claim and the price you paid for your car—is covered by GAP insurance.

For illustration, suppose you spent £30,000 on a brand-new vehicle. It was written off in an accident after two years. The amount that your standard auto insurance policy pays out is £25,000 as that is the car’s market value at the time of the collision. Leaving you short of the amount you paid for the car. GAP insurance fills that need.